Home sales worsen due to inventory, interest rates

This week, the National Association of Realtors announced that 2024 would likely be an even worse year for home sales than 2023. It could wind up as the worst since the late 1990s.

Existing home sales fell 1% in September to a seasonally adjusted rate of 3.84 million. That number is 3.5% lower than a year ago. Median existing home prices climbed 3% from a year ago to $404,500. That is the 15th consecutive month of year-over-year price increases. At the going rate of sales, there are about 4.3 months’ supply of homes available to purchase. Which sounds like a lot. It isn’t. It should be over six months of inventory to considered a balanced market with an equal number of buyers and sellers.

“Home sales have been essentially stuck at around a four-million-unit pace for the past 12 months, but factors usually associated with higher home sales are developing,” said NAR Chief Economist Lawrence Yun in a press release. “There are more inventory choices for consumers, lower mortgage rates than a year ago and continued job additions to the economy. Perhaps, some consumers are hesitating about moving forward with a major expenditure like purchasing a home before the upcoming election.”

Sure. Blame politics for the slowdown. While it’s true that real estate typically slows for a few months before an election, it seems more likely that the bond market rally and higher mortgage interest rates have more to do with why home buyers put on the brakes.

For the past few years, the entire real estate market has been suffering from a severe lack of homes for sale coupled with interest rates high enough to make everyone’s eyes water. While interest rates are down significantly from a year ago, they’re not at 2.65%. And, that’s the number everyone has stuck in their heads.

A little mortgage history, according to the Federal Reserve of St. Louis: On Friday, Oct. 9, 1981, 30-year fixed mortgage interest rates hit an all-time high of 18.63%. They started to decline significantly a year later, when interest rates fell to just over 14%. By February, 1987, you could get a 30-year fixed rate loan at around 9%. When we bought our first place, a co-op, the interest rate was 11.75%, which we refinanced a couple of years later to a loan of around 8%.

During the Great Recession, between 2008 and 2009, interest rates fell below 6%, then came down all the way down to 2.65% once the pandemic hit. Today’s problem is a short-term memory issue: Everyone knows someone who has an interest rate below 4%.

In fact, nearly 60% of the nearly 51 million active mortgages carry an interest rate below 4%, according to the Consumer Financial Protection Bureau. More than a fifth of all mortgages have interest rates at or above 5%. In August, Redfin estimated that nationwide, 85.7% of U.S. homeowners with a mortgage have an interest rate below 6%, down from a record high of 92.8% in mid-2022.

When interest rates recently fell to 6.5%, approximately 2.5 million borrowers could have refinanced and saved 0.75% interest. But if the vast majority of homeowners with mortgages carry interest rates below 6%, then today’s mortgage rates aren’t low enough to get many folks interested in selling and moving.

Even if they did want to move, the dramatic increase in home prices gives everybody pause. Because if you sell and move today, you’re likely going to buy a home that’s a lot more expensive. And, you’ll finance it with what is likely to be a higher interest rate.

Industry experts including the National Association of Realtors say the U.S. is as many as 5 to 7 million homes short. When supply is that tight, prices rise. The only solution is to build more homes. A lot more. That won’t happen without someone deciding to invest in supporting builders and new building technology, while finding a way to de-risk builder loans for banks and other investors. Homes won’t get built by technology alone.

We also need to find ways to bring a lot more people into the building industry. When homes get destroyed by natural disasters, resources move to those hard-hit areas to begin rebuilding.

But when we’re rebuilding homes, we’re not adding to the overall housing stock. We’re not reducing the enormous shortage of homes. We’re not giving our neighbors and our children a shot at buying into their own American dream.

========

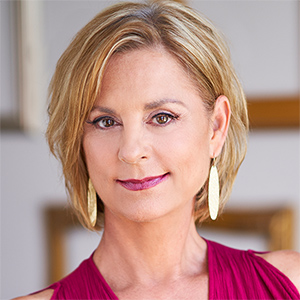

(Ilyce Glink is the author of “100 Questions Every First-Time Home Buyer Should Ask” (4th Edition). She is also the CEO of Best Money Moves, a financial wellness technology company. Samuel J. Tamkin is a Chicago-based real estate attorney. Contact Ilyce and Sam through her website, ThinkGlink.com.)

©2024 Ilyce R. Glink and Samuel J. Tamkin. Distributed by Tribune Content Agency, LLC.

Comments