Parents’ lack of estate planning leads to home ownership debacle with step-siblings

Q: My lawyer can’t seem to get the title cleared on my Florida condominium. My mom and stepdad received title to my grandmother’s condominium as tenants-in-common from my grandmother back in 1995. My stepdad died without a will about 20 years ago. His estate was never probated, as my mom thought everything would automatically go to her.

My mom died four years ago and had signed a Lady Bird deed to me for her condominium. She left a will and we probated her estate in 2022 without any issues. I found out a year ago that the title was not clear on the condominium, as my stepdad’s four children still held an interest in the condominium.

I have been able to locate three of the children, but the fourth has had no contact with his family in over 15 years. My lawyer has filed various documents with the court, and the three stepchildren have signed all documents and have been very cooperative. My lawyer has tried to find the fourth child and has filed documents with the court to show his diligence in trying to find him.

I have now paid the lawyer $8,000, but the issue still isn’t resolved. At this point, I do not know if the three stepchildren have been removed from the title or how to get the fourth kid removed. I do not know how to proceed and welcome any advice.

A: We understand your frustration, but it looks like your attorney is doing what they can to help you out. So, don’t take out your frustrations with your parents’ poor estate planning on your attorney. Your attorney didn’t cause this issue. Your problem started when your mom and stepdad became owners of the condo.

Back in 1995, your mom and stepdad were equal owners of the condo, but their ownership was not titled as joint tenants with rights of survivorship. That meant that when one of them died, their 50% interest in the condo went to their respective kids and not to the other co-owner. Your stepdad could have fixed this issue by having a will that gave his half interest in the condo to your mom. But that didn’t happen.

So, your mom became a co-owner with your stepdad’s kids, even if the kids didn’t know it. Then your mom died and wanted you to have the right to live in the home for the rest of your life. That’s the Lady Bird deed, also known as a life estate. Once you die, her share of the home would then pass on to others, as she might have stated in the life estate document. We’re not going to go into the life estate issue here since we’ve written about it in other columns.

We’ve heard of similar cases to yours. In one, the co-owner thought they owned the home and treated the home as their own. They lived there for many, many years. When they found out they had an issue, they used their state’s statutes to clear up the title to the home.

In some states, if you’ve lived in the home for 21 or more years, paid the taxes on the home, treated the home as your own, never acknowledged that others owned the home with you, you can file suit to clear title to the home. Some states have shortened the period of time to allow title to be cleared. But in both of these situations, you might have to file suit to clear the title. However, litigation can be expensive and may cost more than what you currently have paid the attorney.

Unfortunately, it appears that you’ve acknowledged that your step-siblings have an interest in the home. So, you can’t go down the path of claiming sole ownership and excluding them from their claim. But your state may have other laws in the books that might allow you to get exclusive control over the property.

We suggest you sit down with the attorney and discuss your options. Figure out what it takes in your state to clear up the title to the home. The three stepchildren can convey their ownership in the home to you, if they haven’t already. (Is that the paperwork the attorney had them sign?) You’ll still need to figure out how to resolve the issue of the missing fourth child.

When you discuss your legal options with the attorney, don’t forget to ask how much each option will cost. One last idea: If you ever find the fourth step-sibling, and they give you trouble about signing over their share, consider having a conversation about improvements that have been made to the property through the years and how those will be reimbursed. Good luck.

========

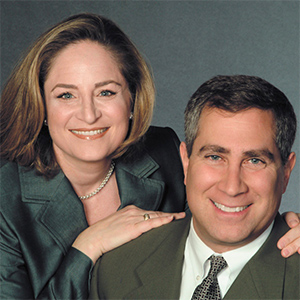

(Ilyce Glink is the author of “100 Questions Every First-Time Home Buyer Should Ask” (4th Edition). She is also the CEO of Best Money Moves, a financial wellness technology company. Samuel J. Tamkin is a Chicago-based real estate attorney. Contact Ilyce and Sam through her website, ThinkGlink.com.)

©2024 Ilyce R. Glink and Samuel J. Tamkin. Distributed by Tribune Content Agency, LLC.

Comments