Mortgage company asks parent for detailed financial information to co-sign daughter’s loan

Q: My daughter is buying a home. The mortgage company wants me to submit a ton of information in order to be her co-signer. They want all pages of my bank statements for the last three months and my tax returns for the last two years. They also want my social security statement and a letter regarding how much I receive in social security payments. This seems highly irregular to me, and I don’t even know where to start. What should I do?

A: We don’t find your lender’s requests unusual at all. You might believe that as a co-borrower the lender wouldn’t need much from you. The truth is that the lender will need as much information from you as they will need from your daughter.

Just about every residential mortgage lender out there will want to know what liquid assets you have. The lender will want to see bank statements from you showing the funds you had in your bank accounts for the last three months. The lender will want to see that you have not received any unusual deposits during the last three months. They need to understand the flow of money into your account.

The lender will also be interested in knowing your sources of income. This means that the lender will want to confirm your employment and your monthly salary. If you’re retired, the lender will want to confirm the amount of any monthly pension payments you receive as well as any monthly social security payments.

Without this information, the lender won’t know whether there is any benefit (to them ) to adding you to the loan. We suspect your daughter may not qualify for the loan on her own and has asked you to co-sign on the loan with her. You need to understand that you will be a full borrower alongside her. And, you and she will each have the primary obligation to repay the loan.

We can also see a situation where your daughter would qualify for the loan on her own: She might have a monthly income high enough to qualify for the loan and has enough assets to get the loan. But, if her credit is shot for some reason, she might ask you to sign with her. Perhaps she had medical debts that she finally paid off, went through a painful divorce that caused her credit to go down or had a life changing situation where she failed to pay her debts on time.

You might have great credit. So, if she adds you to the application, she’ll qualify for a lower rate and better terms. However, the lender will treat each of you separately and need to ascertain the value of each of you as separate borrowers. The lender will look at all of your income, assets, debts, and credit score to see if you alone could qualify for the loan. They will also look at how you strengthen your daughter’s application.

When they do this, they will pull a credit report on each of you, ask for bank and investment statements, and require each of you to complete a loan application. They will then need to verify all of your accounts and sources of income.

We suggest that you follow through with these lender’s requests. If you don’t, the lender won’t approve the loan and your daughter won’t close on the purchase of her home.

========

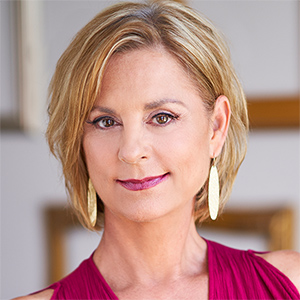

(Ilyce Glink is the author of “100 Questions Every First-Time Home Buyer Should Ask” (4th Edition). She is also the CEO of Best Money Moves, a financial wellness technology company. Samuel J. Tamkin is a Chicago-based real estate attorney. Contact Ilyce and Sam through her website, ThinkGlink.com.)

©2024 Ilyce R. Glink and Samuel J. Tamkin. Distributed by Tribune Content Agency, LLC.

Comments