Reader suggests more options for parents helping adult children with mortgage loans

Q: I am a faithful reader of your Real Estate Matters column every Sunday. I am moved to comment on your advice to the retiree who was trying to be a co-signer on his daughter’s mortgage. While the retiree’s query revolved around the dangers of co-signing, there could be several other much less costly and intrusive options.

Maybe the father is hesitant to co-sign because he has other children and wants to be uniform in his treatment of them all. The assumption is the daughter is able to make the payments herself and her father merely was an instrument to qualify for the purchase loan.

Why can’t the daughter finance the loan on her own? This removes the retiree’s obligation and allows the daughter to independently move forward with her finances after her father lent a helping hand. Of course, if she gets a better interest rate on the current loan because of her father, that would explain it.

But, if Dad doesn’t want to be on the loan but wants to help his daughter, he can become “the bank” and the daughter makes payments to him. The daughter can be on title and the payment can be structured as a loan payment.

I believe you could have suggested these options in your reply.

A: You are correct in that there are a number of angles and options parents can take when they help out their children.

Your primary suggestion that the father could loan the money to the daughter is a good option. But, it implies that the father has the funds available to become the daughter’s lender.

The vast majority of Americans in retirement simply don’t have the cash available to pay off a child’s mortgage. Even if they could, the interest rate they might receive could be less than they’d earn from long-planned investments.

Let’s say the father is a retiree with a large pool of available cash. He has the resources to become the lender, going forward. The daughter could pay interest to her dad and deduct the interest. Dad would pay taxes on the income received from the daughter. That’s fair.

To keep this legit, the parent and child would need to paper the loan by having the daughter sign a note and give the parent a mortgage on the home. The parent might also need to deliver Internal Revenue Service (IRS) form 1098 showing the interest payments received by the child and send a copy of the form to the IRS.

With any of these options, parents have to be comfortable with the entire arrangement. Particularly as they enter or are living in retirement. And there are financial worries that underline how comfortable a parent might be.

For example, sometimes parents find they need additional cash flow, and need to dip into their nest eggs. That’s hard to do if your nest egg is locked away in someone else’s house. Parents may also worry what will happen to their money if they have disagreements with their kids. Or, if their child loses a job and stops making payments altogether. Or, if the parent needs to get their own loan for a home purchase and worries that co-signing with their kid will hurt their ability to get that loan.

Our letter writers don’t always provide as much detail about their lives as we’d like, so we often have to guess around intentions and relationships. In this case, it would have been helpful to know more about the financial circumstances of the parent and child. And, also why the Dad is a bit hesitant to provide his personal information.

Each of these options requires some deep thought on the part of parent and child and a serious conversation about the “what ifs” that exist.

To our readers: In this era of higher interest rates, have you opted to become your child’s lender? If so, we’d like to hear about your experience and the lessons you’ve learned. Please email us at Questions@thinkglink.com. We’ll publish your replies in a future column.

========

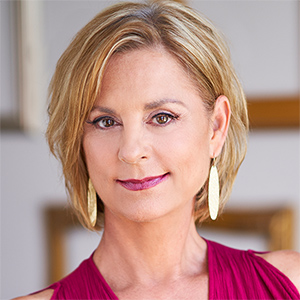

(Ilyce Glink is the author of “100 Questions Every First-Time Home Buyer Should Ask” (4th Edition). She is also the CEO of Best Money Moves, a financial wellness technology company. Samuel J. Tamkin is a Chicago-based real estate attorney. Contact Ilyce and Sam through her website, ThinkGlink.com.)

©2024 Ilyce R. Glink and Samuel J. Tamkin. Distributed by Tribune Content Agency, LLC.

Comments