Editorial: When government has to subsidize people's property taxes, something is badly wrong

Published in Op Eds

How do you know property taxes are too high in this state?

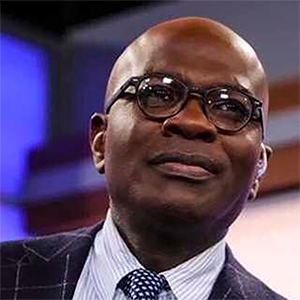

Most homeowners if asked that question would laugh at the notion that there was any doubt. But there hardly could be starker evidence than that local politicians, led by Cook County Assessor Fritz Kaegi, are proposing to have taxpayers cough up more money — potentially lots of it — to help lower-income households cover their property tax bills.

Wait, you might say. Aren’t property taxes supposed to fund local government? Are you telling us that government now needs to find money to help pay a substantial slice of the property taxes that are meant to … well … fund the government? The irony couldn’t be richer.

But that’s where we are in Illinois, and more particularly in the south suburbs of Cook County, where homeowners recently suffered massive sticker shock when they opened their property tax bills. The median increase in that part of Cook County was nearly 20%, according to the county treasurer’s office. But the hikes were far steeper for many, adding thousands to their annual bill.

The reasons for the unusual spike are multifaceted, but essentially homeowners are bearing a significantly higher share of the burden to fund their schools, municipal governments and the county (among other taxing bodies) than used to be the case. Commercial property values generally have suffered since the pandemic while residential values have performed relatively well. Taxing bodies get their money no matter who pays what, so reductions for businesses mean increases for homeowners if, as is the case now, residential values hold steady or rise.

For the south and west suburbs, local governments approved $265 million more in property tax this year. Households are paying all of that increase and more, seeing their bills rise collectively by $400 million while commercial owners experienced a collective $122 million decline.

This frustrating zero-sum aspect of property taxes wouldn’t make for such a crisis if the tax levies themselves weren’t so high.

In recent weeks, Kaegi has said he’s putting together proposed state legislation that would establish a “circuit breaker” for households with low and modest incomes. If their taxes rose above a certain level, the rest of what they owed would be covered by a fund, established by the state, Cook County, or both. The assessor says this approach isn’t unusual; 29 states have some form of property tax circuit breaker. Until about a decade ago, Illinois provided one for low-income seniors. (The circuit breaker was distinct from and in addition to the senior exemptions, which still exist.)

The cost of subsidizing property tax bills in the south and west suburban region alone likely would be in the tens of millions, according to the assessor’s office, which says it will have a better idea of the price tag next month after it completes an analysis of that question. Similar residential spikes occurred in the north and northwest suburbs last year. Kaegi’s office is reassessing values in Chicago as we write, and there is trepidation around whether Chicago homeowners will see similar increases next year.

One can only imagine the cost for providing such relief throughout the Chicago region and even statewide. It’s not as if property tax stress is confined to Cook County.

The Cook County Board has discussed using late fees to help cover such a subsidy program — yet another irony, since those fees are largely the result of unaffordable tax bills in the first place. The county as of May collected $54 million in late fees, well above the $35 million that was projected. Another clear sign of the pain being felt.

It is certainly true that property tax bills in the south suburbs, which are home to a greater percentage of low-income residents than other parts of the region, constitute an emergency. Too many people could lose their homes because their property tax bills simply aren’t affordable.

So a governmental response is in order. Whether it’s the proposal Kaegi is putting together or some other relief, we’ll wait for the details to opine on the particulars.

But any meaningful response will cost big money, it’s clear. And the state government, which for decades has acknowledged that Illinois’ extraordinarily high property taxes (second only to New Jersey nationwide) are an issue, is likely to be the body voters and municipal officials look to for answers.

Last year, Gov. JB Pritzker signed a budget that imposed $900 million in new taxes, taking care to keep the vast bulk of that increase away from residents. But in so doing, Pritzker and fellow Democrats in the General Assembly used up most of the “painless” revenue options at their disposal. A moribund state economy, caused in no small part by a Chicago economy that’s stuck in the mud, is likely to mean more tough budgetary choices next year.

In 2025, Springfield already has to address a funding gap of something like $700 million for Chicago’s transit agencies. Now, it appears, Pritzker and company will be asked to provide another large sum, not for infrastructure or services or new programs, but simply to subsidize local residential tax bills. Who will be asked to foot the bill? Businesses already pay a state income tax that is among the highest in the nation.

In the absence of far more robust economic growth — and, yes, the state and local tax burden is a big reason Illinois’ economy is so lackluster — Democrats in Springfield, who enjoy supermajorities allowing them to call all the shots, need to face the reality that continuing to raise taxes and boost spending in this environment ultimately will lead to painfully deep cuts when the next recession hits. Their mindset needs to change fundamentally. Start trimming and prioritizing now.

They also need to think bigger about how to rely less on property taxes to finance the local government services — police, fire, schools, parks — felt most directly by Illinoisans. Kaegi’s coming circuit breaker proposal should be seen as a canary in a coal mine. The path we’re on right now is leading us deeper into the shaft.

_____

©2024 Chicago Tribune. Visit chicagotribune.com. Distributed by Tribune Content Agency, LLC.

Comments