Why Hasn't Trump Repealed Biden's $50 Billion Backdoor Business Tax Increase?

The Trump administration took a well-deserved victory lap last week for repealing more than 100 Biden-era rules for every new regulation. This will save U.S. businesses potentially hundreds of billions of dollars of unnecessary costs. Gone are discriminatory racial preferences, Green New Deal mandates and electric vehicle mandates -- to name a few.

President Donald Trump has solidly established himself as the "deregulation president."

That's why it's an ongoing mystery why the Trump Treasury Department and IRS have refused to repeal one of former President Joe Biden's most onerous rules of all: targeting business partnerships for $50 billion of new tax liabilities. Business partnerships are a common legal form of American business arrangements.

This giant stealth tax increase was NEVER voted on or approved by Congress. It appears to be a blatant violation of the constitutional requirement that all tax bills start in the House of Representatives. The House never even saw this tax hike coming. Talk about a "danger to democracy."

The U.S. has more than 4 million partnerships -- employing more than 10 million people -- that could be affected.

Many small family businesses use partnership arrangements routinely.

The U.S. Chamber of Commerce, the Heritage Foundation, Americans for Tax Reform, the National Taxpayers Union and the Job Creators Network have all urged the GOP to rescind the Biden backdoor tax increase.

Back in September, The Wall Street Journal pummeled the Biden rules as an "extralegal" plot to go around Congress and squeeze higher business taxes out of employers. The Journal notes that the tax hike was finalized just days before Trump took office, as part of the quest for more revenue to pay for trillions of dollars of budget-busting programs.

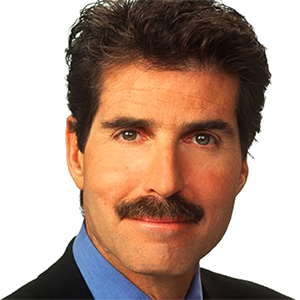

These partnership rules are "functioning like the administrative state's own version of a deep state rebellion," writes my friend and Unleash Prosperity colleague Steve Forbes. They are nothing more than a tool for "punishing Main Street."

He's right. The regulations created a new IRS auditing SWAT team with agents whose sole purpose is to harass partnerships in a guilty-until-proven-innocent "compliance" process. Several companies are facing multibillion-dollar retroactive tax assessments that go back four to five years. These are deductions on activities that were previously untaxed under the IRS code. So much for the rule of law.

The Trump administration has supercharged the U.S. economy for 2026 in no small part by repealing these kinds of Biden-era anti-business taxing and regulating policies.

Former Trump chief economist Larry Kudlow is predicting 4% to 5% growth for the year ahead. Reaching that ambitious target would be an amazing feat made all the easier to achieve if the Trump IRS would repeal the most conspicuous remaining anti-business Biden policy: the $50 billion sucker-punch assault on legal business partnerships.

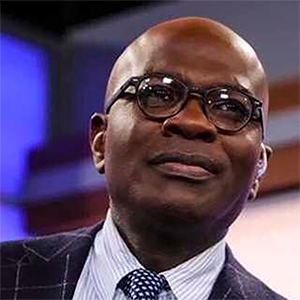

Stephen Moore is a former Trump senior economic adviser and the cofounder of Unleash Prosperity, which advocates for education freedom for all children.

Copyright 2026 Creators Syndicate Inc.

Comments