After 33 years, it’s time to say goodbye to Real Estate Matters (part one)

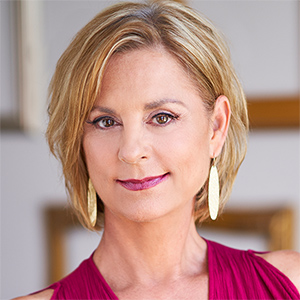

Bestselling real estate author and expert Ilyce Glink and Chicago-based real estate attorney Sam Tamkin have been writing this column continuously since 1993.

This is Real Estate Matters column number 1,726.

That means we’ve been writing Real Estate Matters every single week for 33 years straight — more than three decades of insights, answers to your questions, and front-row seats to one of the most turbulent, fascinating periods in American real estate history.

And now, it’s time to say goodbye.

When we started in 1993, the world looked nothing like it does today. If you wanted to find a home, you opened the Sunday newspaper. If you needed mortgage information, you called a lender and waited for them to call you back. Real estate was a business built on information asymmetry: agents and lenders knew things that consumers simply couldn’t access.

Over these 33 years, Sam and I watched that world transform beyond recognition. We witnessed boom and bust cycles, experienced a digital revolution, and answered thousands upon thousands of your questions — about inheritance disputes, underwater mortgages, first-time buyer jitters, neighbor conflicts, broker behavior, and everything in between.

Let’s start with the technology revolution. In 1993, “virtual tour” wasn’t even a concept. Video wasn’t possible. Today, buyers tour homes on their phones, make offers via DocuSign, and close remotely. Zillow, Trulia, Realtor.com, Homes.com, and dozens of other platforms put property information at everyone’s fingertips. Our column grew from eight newspapers to 135 at the peak, reaching millions of readers navigating this brave new digital world.

Interestingly, while technology changed how people access information, it didn’t change human nature. People still make emotional decisions about homes. They still need guidance through the biggest financial transaction of their lives. They still call their parents before signing a contract, and not only because they need them to qualify for their mortgages.

These past three decades, we’ve lived through several boom-and-bust cycles. First, there was the late ’90s boom. Then, the catastrophic 2008 financial crisis, which decimated property values and cut our newspaper distribution from around 135 to 70. The post-pandemic sellers paradise, where homes flew off the market in days and buyers waived every contingency imaginable. And now, the affordability crisis of 2025-2026, where the median home price hit $446,000 last year and nearly 75% of U.S. households can’t afford a median-priced home. Where first-time buyers have aged from 33 to nearly 40, according to the National Association of Realtors. Where homeownership now consumes nearly 48% of the median household’s income. Right now, it’s cheaper to rent than buy almost everywhere in the country — but renting isn’t cheap either.

Through every cycle, one message held: people don’t buy homes because of interest rates or market conditions. They buy because of life changes — new jobs, growing families, aging parents, marriage, death. The market matters. But life matters more.

From the mid-1990s through 2021, mortgage rates stayed under 6%, often dramatically lower. The pandemic brought us 30-year fixed-rate mortgages at around 2.50% — essentially free money. Then rates climbed back above 7%, shocking a generation of buyers who’d never known anything else and creating millions of “golden handcuff” homeowners, trapped in homes they can’t afford to leave.

It’s interesting to note that housing affordability isn’t just about the sticker price. It’s the combination of price, rates, wages, and availability — and when those forces move against each other, the damage is significant and the recovery time is extended.

Climate change is something we never anticipated writing about in a real estate column. But by 2023, climate change had become a central factor in property values and insurability. Insurance companies pulled out of Florida. Wildfires ravaged California. Hurricanes intensified. And suddenly, location wasn’t just about school districts and commute times — it was about whether you could even get insurance coverage on your home – and if you could, at what price.

But for all the seismic shifts, some things stayed remarkably constant. Every generation wrestles with the same issues: estate planning confusion, inheritance battles, neighbor disputes, first-time buyer anxiety, and the agonizing question of whether to stay or downsize.

Human nature doesn’t change. Families still fight over property. Parents keep putting their kids on title to “protect” the equity. People still make emotional financial decisions. Real estate still brings out the best and worst in us.

At the end of the day, we’ve learned a few things. Homeownership builds wealth. Despite some economists who argue otherwise, for the average American, no other vehicle comes close. Every mortgage payment is enforced savings, and in nearly every market, homes generally appreciate over time.

Good agents become more valuable, not less, as technology advances. Buying the wrong home is an expensive, life-changing mistake. No algorithm replaces the context and judgment a great agent brings.

And education matters more than ever. Real estate transactions have grown more complex. Our job, for 33 years, was to translate that complexity into language ordinary people could understand and act on. Answering those questions, and knowing we’ve helped thousands upon thousands of buyers, sellers and investors through the years has been enormously rewarding.

Still, while we’ve made the decision to step back from this column, Ilyce and Sam are not disappearing. In addition to co-writing this column, Ilyce has run Think Glink Media, her content consulting and production company, and built and sold a financial wellness technology company. Sam has helped thousands of buyers, sellers, and investors realize their real estate dreams. You can still find us at ThinkGlink.com and SamTamkin.com.

But before we go, we want to pull out our crystal ball one more time and talk about how we believe AI is going to fundamentally change the way homes are built, bought and sold. So, for our next — and final — column, we’ll look ahead at the revolution already underway; and it’s going to be extraordinary.

========

(Ilyce Glink is the author of “100 Questions Every First-Time Home Buyer Should Ask (4th Edition).” She writes the Love, Money + Real Estate Newsletter, available at Glink.Substack.com. Samuel J. Tamkin is a Chicago-based real estate attorney. Contact Ilyce and Sam through her website, ThinkGlink.com.)

©2026 Ilyce R. Glink and Samuel J. Tamkin. Distributed by Tribune Content Agency, LLC.

Comments