What a brief port strike on the East Coast means for your holiday shopping

Published in Slideshow World

Subscribe

What a brief port strike on the East Coast means for your holiday shopping

On Oct. 1, thousands of dockworkers with the International Longshoremen's Association, the union overseeing dockworkers across East Coast and Gulf Coast ports in the U.S., went on strike. Forecasts warned it could cost the U.S. economy billions of dollars a day and cause supply chain disruptions at a time when retailers are stocking up for the holiday season. However, within three days, the strike had been suspended, and goods ranging from fruit to furniture were again being moved in and out of the ports, which account for over half of all container imports to the U.S.

While the strike's short length may have caused a sigh of relief among supply chain managers, it still left ripple effects on U.S. trade. Truck Parking Club examined data from the Bureau of Transportation Statistics to uncover the impact of the dockworkers strike on the supply chain.

"The U.S. port strike has ended, but the impacts are far from over," Mia Ginter, director of North American Ocean Shipping at the logistics company C.H. Robinson, told Supply Chain Dive. "A week of disruption typically leads to at least a month of delays at the ports, and these delays increase as you move inland."

Fortunately, retailers' bulking up on inventories and the stoppage's quick resolution may have helped avoid the worst outcomes for holiday shoppers. Even so, read on to understand how this interruption in operations works its way up to consumers.

Visit thestacker.com for similar lists and stories.

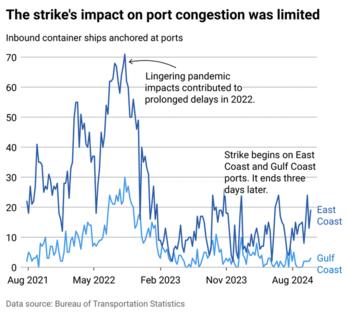

Delays were mostly avoided

In 2022, port congestion and supply chain backups reached high levels. Across ports on all coasts, ships spent longer time awaiting berths, and more ships were anchored near ports. Still, logistics professionals may have learned their lesson from the prolonged backups in the aftermath of the COVID-19 pandemic.

McKinsey surveys among supply chain leaders showed more were bulking up inventories and relying on multiple sources for raw materials to maximize resilience in the aftermath of the pandemic.

Similarly, leading up to the October 2024 strike, more companies ramped up their stock before a stoppage was officially announced. This front-loading of imports was a reaction to both a looming deadline for an ILA contract and a way to cushion any effects from the latest round of tariff increases on imports from China.

Major toy manufacturers Hasbro and Mattel, which routed most of their goods through West Coast ports, hit peak production and shipments during August and September, meaning the strike will likely have little impact on hot 2024 holiday toys.

As the risk of a strike progressed, some companies also leaned more on West Coast ports. Costco and Levi Strauss & Co. were among the brands that shifted imports to West Coast ports from the East Coast.

Amid front-loading and rerouting, the Ports of Los Angeles and Long Beach, California, experienced their busiest month on record in July and August, respectively, handling over 900,000 20-foot equivalent containers each. Officials say the Port of Los Angeles has the capacity to handle 1.2 million containers a month, and data shows there hasn't yet been a bump in the number of container ships awaiting berths.

Across the West Coast, officials aren't forecasting delays that would impact holiday shopping. Rerouted imports would likely arrive as peak shipping season is wrapping up, meaning ports will be more prepared to absorb any additional goods.

Still, efficient ports are just one part of the supply chain.

Matt Smith, head analyst at the trade data and analytics firm Kpler, told Stacker: "It's not just about getting the container ship in, it's all of the other logistics that are set up as a series of dominoes to be actioned once that cargo is discharged."

Front-loading and redirected ships added warehousing and transportation costs to goods that otherwise would've been shipped later on the East Coast.

In the aftermath of the strike, load-to-truck ratios—an indicator of how many shipments there are relative to trucks—increased at the national level but cooled the following week. Spot rates, what shippers pay to move goods, are up slightly in October, but still below rates seen at the start of the peak season.

These increases may be partially connected to the strike but are also likely tied to the simultaneous arrivals of two major hurricanes in the Southeast.

Luckily for consumers, the disruptions are expected to be minimal. The National Retail Federation expects no impact from the strike on the holiday shopping season.

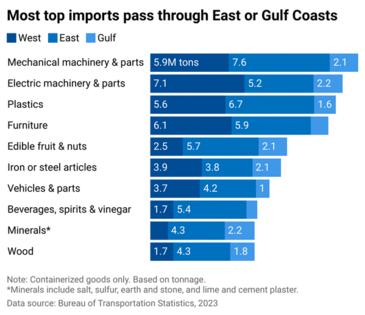

Which goods come through each coast?

East Coast and Gulf Coast ports already account for more than half (56%) of container imports, but their dominance is even more pronounced for certain goods. When it comes to minerals, beverages, wood, and fruits or nuts, the two regions account for over 75% of imports, meaning prolonged disruptions could have had stark effects on those goods.

While a prolonged strike was avoided, the ILA and the United States Maritime Alliance haven't technically agreed on a new contract. Their October agreement set new wages and extended the current contract until Jan. 15, 2025. Supply chain managers will likely be watching the negotiations closely to prepare for future potential stoppages.

Even if a new contract is signed by January, the risks of supply chain backups are never far away. Whether it's the Red Sea crisis, a drought in the Panama Canal, or devastating hurricanes, a number of geopolitical and natural forces can impact trade and port congestion.

"There's a whole manner of different things that can cause supply chain disruptions. Some are visible, and some you just cannot prepare for," Smith said.

Story editing by Carren Jao. Additional editing by Kelly Glass. Copy editing by Paris Close. Photo selection by Clarese Moller.

This story originally appeared on Truck Parking Club and was produced and distributed in partnership with Stacker Studio.

Comments